Anuga Meat is being staged in Halls 5, 6 and 9 of the Cologne fair grounds. Comprising of the sub-segments sausages (Halls 5.2 and 6) red meat (Halls 6 and 9) and poultry (Hall 9) it offers the trade buyers an excellent orientation.The exhibiting companies include 2 Sisters Storteboom, ABP Group, AJC International, Amadori, Bell, Beretta, Borgmeier, Campofrio, Citterio, Danish Crown, Inalca, JBS, LDC, MHP, Nippon Ham Foods, Plukon Poultry, Rügenwalder Mühle, Smithfield, Tönnies, Tyson Foods, Vion, Westfleisch, Wiesenhof and Wiltmann. There are large joint participations from Argentina, Australia, Belgium, Brazil, Germany, France, Italy, Canada, Austria, Spain, South Africa, Turkey and the USA.

Meat production and consumption continues to increase worldwide

The OECD and FAO expect the worldwide meat consumption to increase further over the coming years. The reason for this is the growing world population and the economic development in numerous countries. In concrete terms, the world meat production is expected to increase from 297 million tonnes in 2011 up to 350 million tonnes by the year 2021. With a growth rate of 2.2 percent per year, the increase in

poultry meat is expected to rise more significantly than for beef (+1.8 percent) and pork (+1.4 percent). As such, the poultry share of the world meat production will increase up to 37 percent. Pork will also account for 37 percent of the market share. The 200 million tonne mark was exceeded for the first time in the mid-1990s. In the past 50 years, the global meat production has thus quadrupled.

The meat production has also developed positively throughout Europe and according to estimates by the EU Commission is expected to grow further in 2015 and 2016. For the current year, the EU is expecting a meat production of 45.1 million tonnes of meat in total, 1.3 percent more than in 2014.

On the meat and meat products export market, Russia's import ban is still having a significant effect on the German and European exporters. However, these losses were almost compensated for by exports to Asia.

German meat industry exports at a high level

The development of new export markets is of existential importance for securing the turnover of the German meat industry. The German meat companies have thus been working together successfully for six years in German Meat, the joint export promoting organisation of the German meat industry. German Meat is organising a group participation at Anuga 2015.

Having exported a good 4.2 million tonnes in 2014, the German meat industry once again attained a high level and was able to record growth again (+3.7 percent). Nevertheless, the export revenues declined by almost two percent down to around 9.6 billion Euros due to the lower raw material prices. The most important importing countries for meat and meat products from Germany are the EU countries, 80 to 90 percent of the volumes exported go to these countries.

Last year, meat and sausage products accounted for 12.8 percent of the total German export volume. The German meat products industry was thus able to increase its share of the total export of the meat sector again (previous year 12.3 percent).

Imports on the other hand stagnated. For example, the volume of fresh and frozen beef imported last year totalled 296,000 tonnes, which corresponded to a 3.4 percent decline compared to 2013. The main supplier countries are the Netherlands, Poland and Austria. Yet, a considerable share of beef deliveries from the Netherlands most likely comprise of goods primarily from South America and the USA, which are imported into the EU via the port of Rotterdam.

The export business is the important pillar of the East Westphalian Tönnies Group. Over half of the annual production of the German number one in the meat business is exported. The company has 25 foreign offices, for example in Belgium, France, Italy, Spain and Great Britain, Sweden and Denmark. In Eastern Europe, Tönnies is represented with sales locations in Poland, the Czech Republic, Hungary, Romania, Russia and the Ukraine. Tönnies recently also received a license to deliver its pork to the important US market.

Consumption in Germany

With a statistic per capita consumption of 38.2 kg, in spite of a decline of 0.3 kg, pork is still the most popular meat among the domestic consumers. The price differences between the different types of meat also plays a role here, which clearly works in the favour of the less expensive poultry. Here the per capita consumption remained stable at 11.5 kg. The consumption of beef declined only slightly by 0.1 kg down to 8.9 kg. The consumption of lamb and goat's meat amounted to 0.5 kg and other types of meat (particularly game and offal)totalled 1.2 kg.

Traditional, family-run sausage manufacturers such as Rügenwalder Mühle live from their continuing innovativeness. For example, vegetarian products saved the turnover of the brand name sausage company in the light of the Germans' conservative sausage consumption. According to the company, the vegetarian segment that was introduced in December 2014 is currently growing by 15 percent.

European initiatives for animal welfare and consumer protection

In the scope of the Animal Welfare Initiative, the industry launched an exemplary project over the past months, which improves the conditions for the majority of the pigs kept in Germany beyond the legal standard. From the very start, over 2,000 agricultural businesses will take part in the project with more than 12 million pigs. The farmers receive the financial compensation for the additional expenses involved from a fund, which is financed by large retail companies. The system was co-developed by the meat industry in an elaborate process and is supported by the participation of the slaughter companies.

The board spokesmen of Westfleisch eG, Helfried Giesen, described the industry initiative as the "biggest animal husbandry promotion programme of the last 20 years". Considerable funding for company investments in animal protection would be mobilised. The trade also sees itself obliged to improve the animal welfare conditions across the entire supply chain. A guideline presented by Aldi Süd is to serve the employees as well as the business partners as a binding framework for action. Many points contained therein are already implemented by the company itself or controlled by service providers. In this way, the discounter wants to address the reproach that its favourable prices are possible because the animal protection standards are not adhered to.

The main focus of the New Zealand meat industry lies on the other hand on origin and quality assurance. In the meantime, New Zealand lamb sets worldwide standards in terms of food safety.

The "Label Rouge" in France has already been an established official quality seal for sustainable poultry products since the 1960s. In addition to maximum safety for the consumer, the French poultry producers guarantee with this quality seal the implementation of slowly growing meat breeds that are held in free-range farms and which are not allowed to be slaughtered until they reach sexual maturity.

The VLAM, Flanders' Agricultural Marketing Board, has been occupying itself with the quality of the Belgian pork production for a long time and works closely together with the German quality assurance system QS to this end. At the start of 2014, the Belgian neighbours launched the Belpork standard, an initiative to curb the use of antibiotics to fatten up pigs.

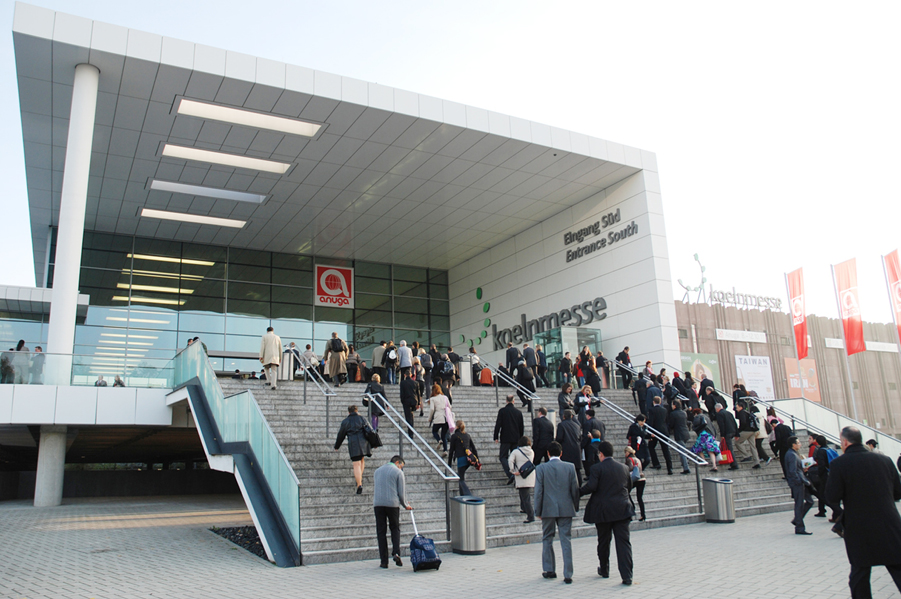

Anuga is exclusively open to trade visitors from the retail and gastronomy trades from Saturday, 10 October 2015 until Wednesday, 14 October 2015, from 10:00 a.m. until 6:00 p.m. on all days.